YOUR DREAM HOME SHOULDN’T BE A NIGHTMARE

YOUR DREAM HOME SHOULDN’T BE A NIGHTMARE

SLASH YOUR FIRST PROPERTY COSTS – SAVE UP TO RM150,000 NOW!

What will happen if you dont know how to do it?

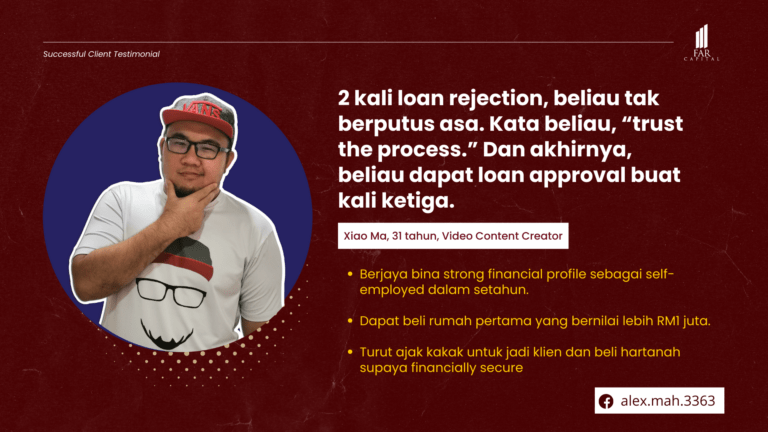

Here is our client’s story.

READ THIS

Dr. Syakur is an ER trauma doctor and lecturer who purchased a house as a long-term investment.

However, he later realized that he had lost money on the investment and had not received any returns.

Yes, a real story. This guy lost RM140,000 when he bought a landed property.

The worst part is he was trapped in negative cashflow and was unable to sell the property.

This was a difficult situation for him to be in.

What if we showed you a way to

-

keep your hard-earned money -

pay minimal upfront costs to purchase a property -

generate positive cashflow in your bank account every month

-

keep your hard-earned money -

pay minimal upfront costs to purchase a property -

generate positive cashflow in your bank account every month

Over 22,000 people choose FAR Capital to buy their property.

When you want to buy a house for the first time, you may feel uncertain about whether it’s worth the investment for a long term and for your own stay.

However, rest assured that many others have felt the same way. You are not alone.

Unfair Advantage you will get buying

property through FAR Capital

-

Buy the safest property, that will not lose money -

Buy property with zero or super-low capital -

Buy properties that allow you to unlock a minimum of RM30K cash to support your reno + furnishing cost -

A step-by-step guide to owning your first property with hassle-free -

For those who can’t get a loan today, we will guide you from unbackable to bankable -

Potentially buy a property the booking fee is sponsored by us -

Stop making your landlord rich: Use our Rent to Own program instead, if you are currently renting a house/room

Unfair Advantage you will get buying

property through FAR Capital

-

Buy the safest property, that will not lose money -

Buy property with zero or super-low capital -

Buy properties that allow you to unlock a minimum of RM30K cash to support your reno + furnishing cost -

A step-by-step guide to owning your first property with hassle-free -

For those who can’t get a loan today, we will guide you from unbackable to bankable -

Potentially buy a property the booking fee is sponsored by us -

Stop making your landlord rich: Use our Rent to Own program instead, if you are currently renting a house/room

Unfair Advantage you will get buying

property through FAR Capital

-

Buy the safest property, that will not lose money -

Buy property with zero or super-low capital -

Buy properties that allow you to unlock a minimum of RM30K cash to support your reno + furnishing cost -

A step-by-step guide to owning your first property with hassle-free -

For those who can’t get a loan today, we will guide you from unbackable to bankable -

Potentially buy a property the booking fee is sponsored by us -

Stop making your landlord rich: Use our Rent to Own program instead, if you are currently renting a house/room

Limited to only

500

buyers for 2023, register now to get your slot!

Your submission could not be saved. Please try again.

Your submission has been successful.